Xero 2017 Earnings

Well that's it. I finally have come around and now I'm starting to like Xero Ltd [XRO.NZX].

I previously hated it as an investment. Loved it as a company always have because its founder is from Hawkes Bay and I originate from the same parts.

Rod Drury really is a man with a PASSION.

It looks like to me that this passion is continuing to rub off on people.

My brother Tony Rickard owns a business down there, East Coast Powder Coaters and just recently has switched on over to Xero.

Hes a particular luddite and for him to move on over to Xero from what he previously used is no mean feat. I wonder if it's his wife Helen who's responsible for this.

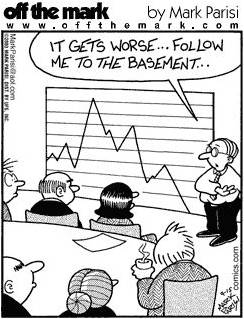

Whether they make a profit or not is part of the mystery. I don't know. Don't think Rod knows either. That was forecast 5 years ago.

I just think if he can get my brother Tony using their software, he can get anyone - given time. That includes the rest of the world. If you have met him and I have on several occasions you just have to ask him about Xero and that's it, you have a one way conversation. He's passionate and I think because i havent even seen the software, there's a bloody good reason for this. It's good.

Anyway Tony's made the move.

I think it's because of the simplicity of the actual product. Its simple. Simple as that.

My bro believes in things that are simple and cheap - otherwise out the door it goes.

In the ten years I've been writing this blog, I've written about Xero around 10 times and interviewed Rod himself 7 years ago.

I get the impression that Rod doesn't particularly like self - aggrandisement he just likes to get down and do it but I think you're on to a winner here and it's just going to take the rest of the world some time to click onto the fact that Xero is a product they should try, try it - you'll love Xero.

Rod Drury: Earnings out tomorrow. He emailed me at 8.50am, the 10 May 2017.

Xero 2017 Earnings

Xero Ltd @ Share Investor

Share Price Alert: Xero Ltd 4

Share Price Alert: Xero Ltd 3

Xero: To those I haven't warned before

Do you still Love Xero?

Share Price Alert: Xero Ltd 2

Share Price Alert:Xero Ltd

Xero Ltd: 2011 HY Loss looking promising

From Xero to Hero?

Stock of the Day: Xero Ltd

Rod Drury ready for the long-haul with Xero

Share Investor Interview: Xero's Rod Drury

Xero Ltd: Download full Company Analysis

Rod Drury on Xero and Growing Business

Xero set for surprise to the Market?

Love Xero?

Share Investor's 2010 Stock Picks

Stock of the Week: Xero Ltd

Discuss Xero @ Share Investor Forum

Listen to Rod Drury Interview

c Share Investor 2017